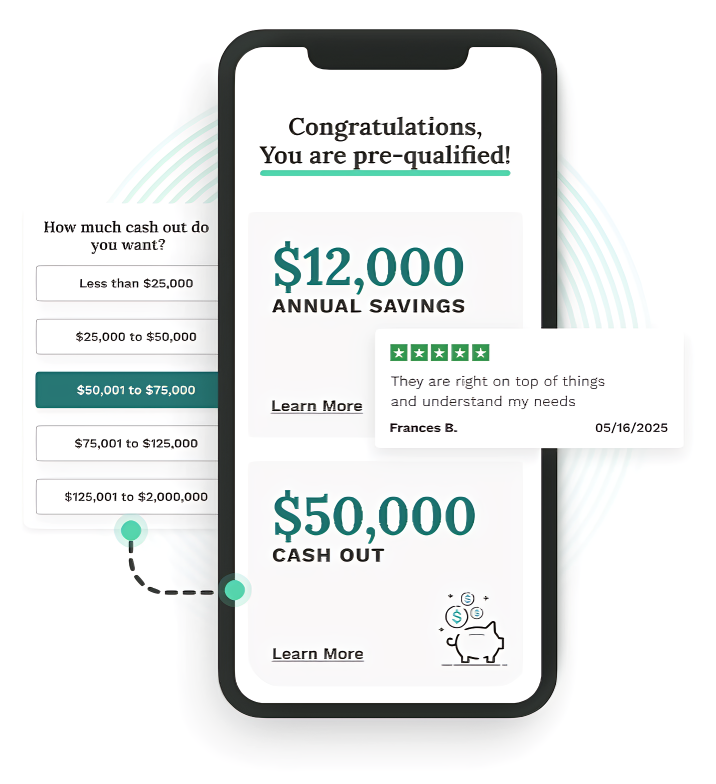

A Smart Way To Find the Best Savings For You

Our tools compare hundreds of loan options to find the right fit for you.

Trusted By Agents With

Personalized Loan Options For You

We offer personalized loan options tailored to fit your unique financial situation and goals. By considering your credit profile and preferences, we create flexible plans with competitive rates and terms that work best for you. Our goal is to make the loan process simple, helping you achieve homeownership or refinancing smoothly and confidently.

Find Your Perfect Home. Schedule a Free, No-Obligation Visit Today

Save Big, Get Cash Quickly

Clients save $1,100 a month on average.

92% of clients discover savings in minutes.

Over $100 million in client savings last month.

Helpful Tools For Your Financial Goals

Explore Programs

Loan Programs Available

Blogs

The Top 5 Mortgage Mistakes to Avoid

Buying your first home can be both exciting and nerve-wracking at the same time. With so many things to consider and...

Mortgage Do and Do not list

Mortgages can be tricky, and it's easy to make mistakes that can end up costing you dearly. That's why we've put together this list....

Tips On How To Improve Your Credit Score

Let's talk about some ways you can improve your credit score! Your credit score is actually a big deal, and it can affect...

Experience Real Savings

Contact

Subscribe to our newletter

Professional & modern, a theme designed to help your business stand out from the rest.

Location

: Miami, Florida 33130, United States

© Copyright 2026

CasaKey Mortgage

© Copyright 2026 Hunter Lending Team. All rights reserved

Hunter Lending Team

.NMLS# - NMLS# 1660690 | 3100 W Ray Road #201 Office #209 Chandler, AZ 85226

NEXA Mortgage LLC is an Equal Housing Lender

Notice To Texas Loan Applicants: Consumers wishing to file a complaint against a mortgage banker, or a licensed mortgage banker residential mortgage loan originator, should complete and send a complaint form to the Texas Department of Savings and Mortgage Lending, 2601 North Lamar, Suite 201, Austin, TX 78705. Complaint forms and instructions may be obtained from the department’s website at www.sml.texas.gov.

A toll-free consumer hotline is available at 1-877-276-5550. The department maintains a recovery fund to make payments of certain actual out of pocket damages sustained by borrowers caused by acts of licensed mortgage banker residential mortgage loan originators. A written application for reimbursement from the recovery fund must be filed with and investigated by the department prior to the payment of a claim. For more information about the recovery fund, please consult the department’s website at www.sml.texas.gov